Real Estate Acquisitions

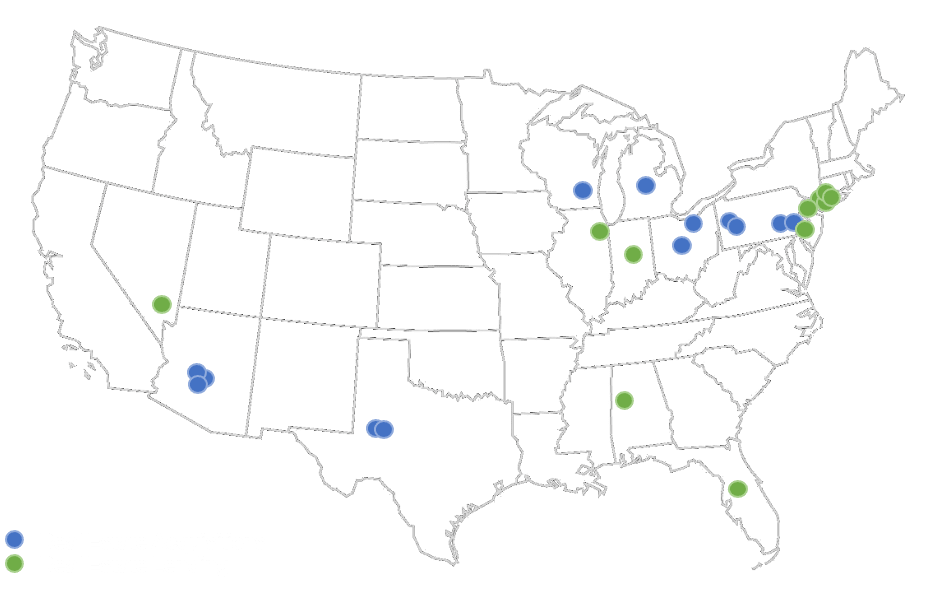

Paragon’s real estate acquisitions platform focuses on investing alongside a select group of strong, repeat operating partners to acquire properties or portfolios ranging in size from $20-$100 million. Our real estate equity portfolio reflects Paragon’s capital preservation and consistent yield orientation, placing a strong focus on stabilized, cash flowing assets that typically represent a core-plus risk profile. Paragon’s flexible capital base allows us to underwrite and own assets with a long-term investment horizon. Our existing portfolio is comprised of industrial, office and medical office, multifamily, and self-storage properties.

Medical Office | Pittsburgh, PA

Esmark Center

Multifamily | Mesa, AZ

Urban Trails

Office | Phoenix, AZ

3900 Camelback Center

Multifamily | Mesa, AZ

Westmount at the District

Medical Office | Pittsburgh, PA

Heritage Valley Monaca Township

Multifamily | Lancaster, PA

The Bradford

Industrial | Midland, TX

Midland Warehouse Portfolio

Industrial | Twinsburg, OH

Amazon Regional Sortation Center

Office | Malvern, PA

ArborRidge Office

Industrial | Whitewater, WI

Golden State Foods Facility

Office | Greenwich, CT

411 West Putnam

Self Storage | Columbus, OH

Columbus Self Storage Portfolio

Industrial | Midland, TX

Midland Industrial Portfolio

Self Storage | Michigan

Michigan Self Storage Portfolio

3900 Camelback Center

Acquisition of a 177k SF office building in Phoenix, Arizona

- In November 2019, Paragon acquired a LEED Gold Certified, Class A office building located in the Camelback Corridor submarket of Phoenix alongside a West Coast operating partner

- The property is fully stabilized and is underwritten to generate a double-digit levered cash yield

Urban Trails

ACQUISITION OF A 156-UNIT MULTIFAMILY ASSET IN MESA, ARIZONA

- In September 2020, Paragon acquired its second Class B garden style multifamily property in the Phoenix MSA

- The property will undergo a value-add capital improvement and unit renovation program to capitalize on the strong market momentum

Westmount at the District

Acquisition of a 154-unit multifamily asset in Mesa, Arizona

- In October 2019, Paragon acquired a Class B garden style multifamily property in the Phoenix MSA with a regionally focused multifamily operating partner

- The property is underwritten to generate attractive cash yields while undergoing a value-add capital improvement and unit renovation program

Heritage Valley Monaca Township

Acquisition of a 59k SF medical office building in Pittsburgh, Pennsylvania

- In October 2019, Paragon acquired a recently constructed, build-to-suit medical office building in the Pittsburgh MSA alongside a repeat operating partner

- The property is 100% leased to an investment grade health system and underwritten to generate a double-digit levered cash yield

The Bradford

Acquisition of a 238-unit multifamily asset in Lancaster, Pennsylvania

- In October 2018, Paragon acquired a Class B garden style multifamily asset in Lancaster, Pennsylvania in conjunction with a Mid-Atlantic focused vertically integrated, multifamily operating partner

- The property is underwritten to generate a high-single digit levered cash yield

- The Property was sold in May 2021, generating a 30.1% IRR and 1.85x MOIC

Midland Warehouse Portfolio

Acquisition of a 13-property industrial portfolio in Midland, Texas

- In April 2018, Paragon acquired a portfolio of 13 single-tenant, triple net leased industrial warehouses in West Texas with a repeat operating partner based in Midland, Texas

- The portfolio is underwritten to generate a double-digit levered cash yield

Amazon Regional Sortation Center

Acquisition of a 248k SF industrial warehouse in Twinsburg, Ohio

- In March 2017, Paragon acquired a Class A industrial property 100% leased to Amazon and utilized as a sortation center in the Cleveland MSA alongside a repeat operating partner

- The property is underwritten to generate a high single-digit levered cash yield

ArborRidge office

Acquisition of a 129k SF office property in Malvern, Pennsylvania

- In October 2016, Paragon acquired a Class A office property in the Philadelphia MSA in conjunction with a local operating partner

- The property is underwritten to generate a double-digit levered cash yield

Golden State Foods Facility

Acquisition of a 100k SF industrial warehouse in Whitewater, Wisconsin

- In September 2016, Paragon acquired a Class A, mission-critical freezer-cooler distribution facility 100% leased to Golden State Foods (now leased to Martin Brower), in conjunction with an operating partner

- The property is 100% leased and underwritten to generate a high single-digit leveraged cash yield

411 West Putnam

Acquisition of a 100k SF office property in Greenwich, Connecticut

- In September 2016, Paragon acquired a Class A office property in Greenwich, Connecticut in conjunction with an office-focused operating partner

- The property is underwritten to generate a high single-digit levered cash yield

Columbus Self Storage Portfolio

Acquisition of a four facility self-storage portfolio in Columbus, Ohio

- In October 2015, Paragon acquired a four-property self-storage portfolio comprised of ~2,500 self-storage units alongside a repeat operating partner

- The portfolio is underwritten to generate a double-digit leveraged cash yield

Midland Industrial Portfolio

Acquisition of a 15-property industrial portfolio in Midland, Texas

- In September 2014, Paragon acquired a portfolio of 15 single-tenant, triple net leased industrial warehouses in West Texas in conjunction with a Midland-based operating partner

- The property is underwritten to generate a double-digit levered cash yield

Michigan Self Storage Portfolio

Acquisition of a 12-facility self-storage portfolio across Michigan

- In August 2014, Paragon acquired a 12-property self-storage portfolio comprised of ~900k SF of rentable square feet across ~6,200 self-storage units, in conjunction with a vertically integrated operating partner

- The portfolio was sold in January 2020, generating a 29.5% IRR and 2.8x MOIC

Esmark Center

ACQUISITION OF A 40K SF BOUTIQUE MEDICAL OFFICE BUILDING IN SEWICKLEY, PENNSYLVANIA

- In May 2021, Paragon acquired a Class A boutique medical office building and Starbucks ground lease located in the Pittsburgh MSA alongside a repeat operating partner

- The property is fully stabilized and is underwritten to generate a double-digit levered cash yield