Real Estate Lending

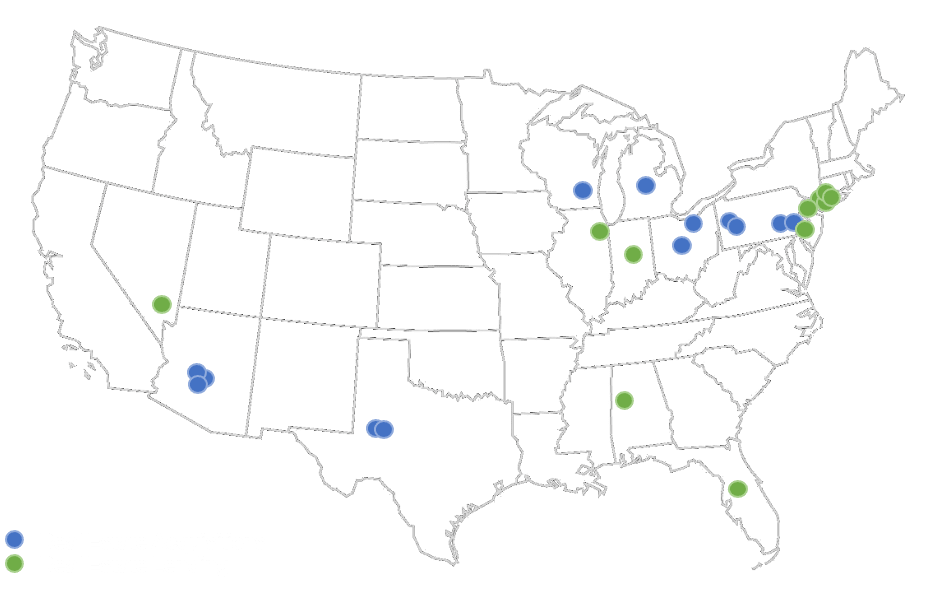

Paragon’s real estate lending platform originates whole loans, mezzanine loans, and preferred equity investments. Our typical deals range in size from $5-$50 million and our flexible capital base provides for a duration-agnostic approach to underwriting, with loan terms ranging from 12 months to 10 years, on either a fixed or floating-rate basis. Our loans can be collateralized either by land, transitional or stabilized properties, and development projects.

Development | Las Vegas, NV

Las Vegas Strip Retail

Condo Development | West Chelsea, NY

West Chelsea Condo Inventory

Office | Indianapolis, IN

Regions Tower

Retail | Tuscaloosa, AL

Midtown Village

Multifamily | Camden, NJ

Victor Lofts

Office | Warren Township, NJ

New Jersey Office

Apartments | Crystal Lake, IL

Skyridge Club Apartments

Condo Development | West Chelsea, NY

West Chelsea Development

Condo Development | SoHo, NY

Soho Condo Conversion

Industrial/Retail | Diversified

Industrial & Retail Portfolio

Condo Development | NoMad, NYC

NoMad Condo Development

Condo Development | New York, NY

Land Acquisition Loan

Condo Development | New York, NY

Land Acquisition Loan

Las Vegas Strip Retail

Mezzanine Loan collateralized by a development site in Las Vegas, Nevada

- In June 2019, Paragon provided a 2-year mezzanine loan to an experienced Las Vegas retail developer backed by a 10-acre development site directly on the Las Vegas Strip with 258k SF of retail development potential

- The mezzanine loan is underwritten to generate a double-digit, floating rate cash yield

West Chelsea Condo Inventory

Mezzanine Loan collateralized by four residential condo units in New York, New York

- In January 2019, Paragon provided a 12-month condo inventory mezzanine loan to a repeat borrower and an experienced NYC real estate developer, backed by four ultra-luxury residential condo units located in West Chelsea, Manhattan

- The mezzanine loan is underwritten to generate a double-digit, floating-rate cash yield

Regions Tower

Mezzanine Loan collateralized by a 695k SF office property in Indianapolis, Indiana

- In September 2018, Paragon provided a 5-year mezzanine loan to refinance a 36-story Class A office building located in downtown Indianapolis

- The mezzanine loan is underwritten to generate a high single-digit, fixed-rate cash yield

Midtown Village

Mezzanine Loan collateralized by a 344k SF retail property in Tuscaloosa, Alabama

- In March 2018, Paragon provided a 3-year mezzanine loan to refinance a Class A open-air lifestyle center in close proximity to the University of Alabama

- The mezzanine loan is underwritten to generate a double-digit, floating-rate cash yield

Victor Lofts

Mezzanine Loan collateralized by a 341-unit multifamily property in Camden, New Jersey

- In November 2017, Paragon acquired a mezzanine loan with 7+ years of remaining term backed by a six-story Class A multifamily property located near the waterfront in downtown Camden, NJ

- The mezzanine loan is underwritten to generating a double-digit, fixed-rate cash yield

New Jersey Office

Mezzanine Loan collateralized by a 370k SF office property in Warren Township, New Jersey

- In August 2017, Paragon provided a 10-year mezzanine loan backed by a four-story, Class A office building in an affluent suburb of New Jersey

- The mezzanine loan is underwritten to generate a double-digit, fixed-rate cash yield

Skyridge Club Apartments

Preferred Equity investment into a 364-unit multifamily asset in Crystal Lake, Illinois

- In April 2017, Paragon made a preferred equity investment into a well-occupied garden-style multifamily property in the Chicago MSA

- The investment has been realized, with received proceeds to date that generated a gross IRR of 15% and gross MOIC of 1.39x

West Chelsea Development

Senior Loan collateralized by a condo development project in New York, New York

- In September 2016, Paragon provided a 30-month land acquisition and development loan backed by a ground-up, boutique luxury condo development located in West Chelsea in close proximity to the Highline

- The senior loan has been repaid in full, generating a gross IRR of 16% and gross MOIC of 1.18x

Soho Condo Conversion

Preferred Equity investment into a condo conversion project in New York, New York

- In September 2016, Paragon provided preferred equity backed by a 5-unit, 16,570 SF boutique luxury condo conversion project in SoHo, Manhattan

- The investment is fully realized and generated a gross IRR of 32% and gross MOIC of 1.17x

Industrial & Retail Portfolio

Senior Loan collateralized by a 21-property industrial and retail portfolio across the United States

- In June 2016, Paragon participated in a 15-month bridge loan backed by a geographically diverse portfolio of distribution centers and retail properties concentrated in California, Florida, and Pennsylvania

- The senior was repaid in full, generating a gross IRR of 11% and MOIC of 1.12x

NoMad Condo Development

Mezzanine Loan collateralized by a condo development project in New York, New York

- In December 2015, Paragon provided a mezzanine loan to fund the excavation and foundation work on a condo development project in Manhattan, leading to successful take-out construction financing

- The mezzanine loan was repaid in full, generating a gross IRR of 19% and gross MOIC of 1.19x

Land Acquisition Loan

Mezzanine Loan collateralized by a condo development project in New York, New York

- In October 2014, Paragon provided a mezzanine loan to an experienced NYC real estate developer, backed by land parcels and developable air rights for a condo development project in Manhattan

- The mezzanine loan was repaid in full, generating a gross IRR of 18% and gross MOIC of 1.47x

Land Acquisition Loan

Mezzanine Loan collateralized by a condo development site in New York, New York

- In May 2014, Paragon provided a mezzanine loan to an experienced NYC real estate developer, backed by land parcels and developable air rights for a condo development project in Manhattan

- The mezzanine loan was repaid in full, generating a gross IRR of 16% and gross MOIC of 1.51x